Swing Trade Idea – June 11, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Slight negative global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals

· Yields: 30Y Bond +.27% Currencies: USA$ +.2% Vix: +2.5%

·

News: USA: 10Y Bond Auction 13:00 ET JP: Machine Tool

Orders improving

Stocks: CXW-17% Govt terminates contract LLY+2% Alzheimer drug FDA board

approval IBIT-3.6% weighing on COIN, MARA; COPX-0.8%, SLV-1% China

Industrial metal futures all lower weighing on miners FCX, BHP,

RIO, TECK, AAPL-.2% WDW reaction negative

Overview: USA SPY 534.2 with support at 533.6, 532, and 530, and

resistance at 535 and 536; SPY expected move +/- 2.1. QQQ 463.6 with resistance

at 465 and 467.8, and support at 462; QQQ expected move +/- 3.0. Global

equities are lower premarket with IWM lagging. Yields are lower but US$ is

higher so a mixed macro set-up. USA market breadth has been increasingly narrow

with S&P supported by MAG7 which like Monday are subdued premarket but can

move on the open when the algos turn on. AAPL and NVDA are the 2 to watch. CPI

and FOMC tomorrow are big events so may see additional hedging into the close.

The 10Y bond auction today at 13:00 ET is the big event given sensitivity to

yields. Today’s daily expected move levels: SPY (535.7-533.6), QQQ

(467.8-461.8), IWM (202.7-199.9), and SPX (5381-5340).

Stocks to watch LLY, GM, SHOP, NVDA, HOOD, NVO, AAPL, CLF

Spec Names

Pre-800ET

Indices UNG, TLT, UUP, IBIT, EFA, IWM, ARKK, FEZ, EWC, XLB, FXI, XLF

S&P500 LLY, FCX, NEM, CMCSA

Movers DXC, VFC, LLY, CXW, ZIM, GOGL, ATAT, FRO, IREN, MARA, TRMD,

COIN, MSTR, CLSK, CLF, BHP, DB, HOOD, HSBC, RIO, FCX, GFI

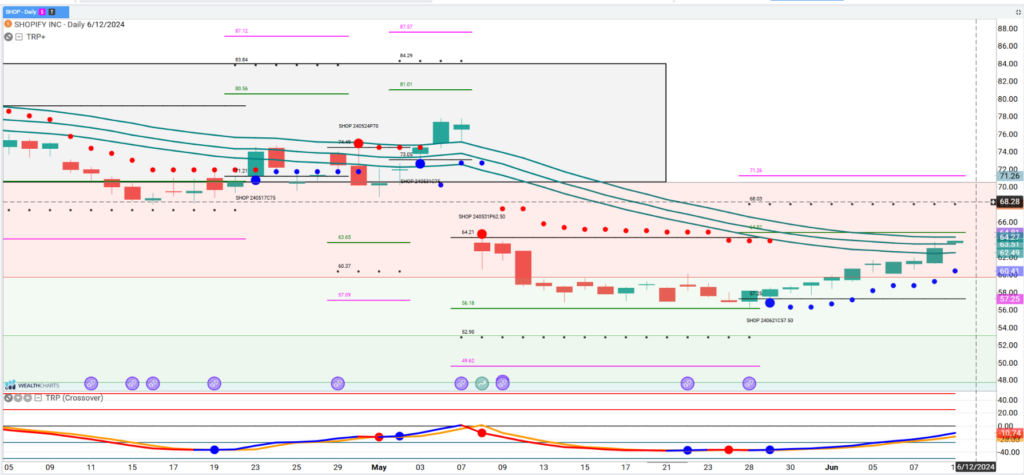

Trade Idea: SHOP

SHOP has been working its way back after an earnings gap down. It’s now approaching the gap where it may enter the gap or reverse. Short term extended and above (30d) value. Momentum trade long over 64 with option market targeting 65 and 70 or pullback trade >=62. Note market overall is stretched with major data releases this week.