Swing Trade Idea – June 12, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong, Asia – Neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals

· Yields: 30Y Bond +.03% Currencies: USA$ -.04% Vix: +0.6%

·

News: USA: CPI 8:30 ET; FOMC 14:00 ET; JP: PPI y/y 2.4%

vs 2%; UK: GDP 0% m/m Ind Prod m/m -.9% vs -0.1% China: CPI y/y

-0.3% vs -0.4%; PPI y/y -1.4% vs -1.5%

Stocks: ORCL+7.5% Boosting all the usual AI names RBRK+2.5%, PETS-8.3%,

ASO-1.8% EPS NIO-3.4%, LI-3%, TSLA-.12% EuroCommission talking large

tariffs on Chinese EVs AVGO+1.7% earnings after close- major SMH holding

Overview: USA SPY 537.8 with support at 535, 532, and 530, and resistance

at 540 and 541.8; SPY expected move +/- 4.8. QQQ 468.8 with resistance at 470

and 473.2, and support at 462; QQQ expected move +/- 5.2. Global equities are

higher premarket ahead of USA CPI release premarket and FOMC meeting 14:00

ET. Premarket IWM is leading which is a risk-on set-up and the factor

which would outperform IF the market views inflation as slowing AND FED not

hawkish. Indices are short term stretched and have advanced on weaker breadth

and with market leaning long, risk of a reversal today if CPI is higher or

Powell is hawkish. SPX 5300/SPY 530 are major bull/bear levels. ORCL earnings

missed but forecast a better future due to … AI which is lifting all of the

usual AI suspects. AVGO is reporting after close and is bid as market has

decided its an AI name and as a major SMH holding will move other semis. QCOM,

MU are 2 of the semi names now in the AI bucket. TSLA is on watch today with MS

upgrade, and a vote on Elon’s pay tomorrow along with European Commission

wanting to tariff Chinese cars. Don’t know whether TSLA can provide all of

European demand from German factory. Today’s daily expected move levels: SPY

(541.75-532.15), QQQ (473.2-462.8), IWM (202-199.2), and SPX (5423-5327).

Stocks to watch ORCL, AVGO, QCOM, NVDA, AMD, AAPL

Spec Names IREN, RNA

Pre-800ET

Indices USO, IBIT, MSOS, ETHE, IWM, XLE, IGV, EFA, UNG, FXI,

UUP, GLD

S&P500 ORCL, AVGO, UBER, INTU, MU, ANET, SMCI, QCOM, PARA, NEE,

ACN, HPQ, AAPL, GD

Movers RNA, RTO, ORCL, Z, GME, TSM, ZIM, GOGL, AVGO, ARM, AFRM, IREN, SAP,

BHP, MSTR, BP, LI, PARA, ASO, BBVA, NEE

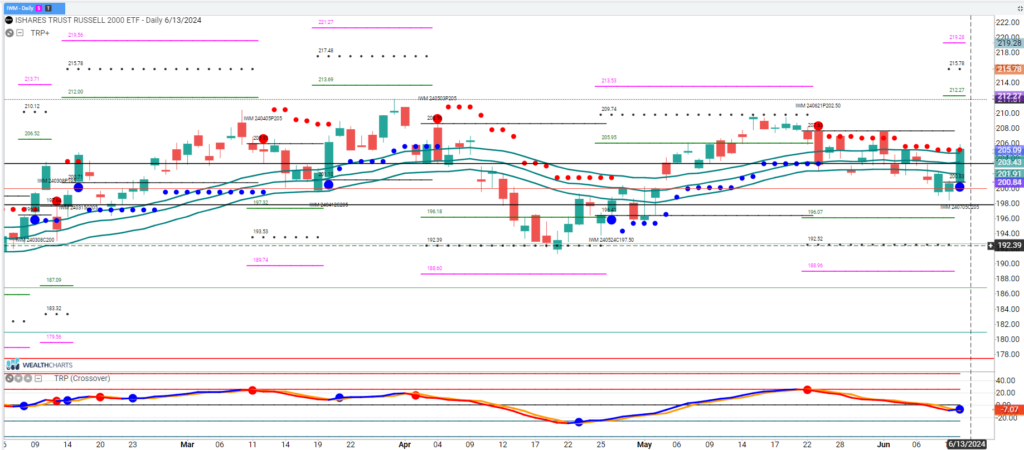

Trade Idea: IWM

CPI came in a massive 0.1% below expectations therefore equities moved higher and the weakest stocks moved the most. IWM is poster child for weak with half of the companies non-profitable. IWM has popped to the top of the weekly expected move hence stretched as most stocks. If long ahead (like me) 205 is a key level. Above it can continue to run higher with 208, 210 targets. A break below 205 is a caution, protect level. Reminder that FOMC at 14:00 ET is a market moving event and can unwind the move. IV is elevated into today which makes the move a mechanical move higher as shorts cover and put hedging is reduced.