Swing Trade Idea – July 1, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Slight positive global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals

· Yields: 30Y Bond -1% Currencies: USA$ -.16% Vix: -1.23%

·

News: USA: ISM mfg PMI 10:00 ET EUR: German CPI 2.2% vs

3.3%; China: Govt PMI weak, private data better

Stocks: CHWY+10.8% Roaring Kitty; SPR+3.9% Boeing buying SPR; IREN+3.8%.

CLSK+2.8% Bitcoin Miners Bid with bitcoin bounce; TSLA+1.5% Rising

ahead of Tues delivery numbers; Banks: Stress tests passed, banks bought

France: First wave of election as expected, Euro bought

Overview: USA SPY 545.2 with support at 545, 543, and 541, and

resistance at 546, 547.2, and 550; SPY expected move +/- 3. QQQ 480.4 with

resistance at 481, 482.5, and 485, and support at 480, 478, and 475; QQQ

expected move +/- 3.4. Macro set-up is mixed with yields strongly higher and

US$ slightly lower. US$ is slightly lower on Euro shorts covering after

election went as expected. Usually long yields +1.3% is negative for small

caps, financials, staples and speculative stocks in general but that is not

reflected in premarket. USA indices are slightly higher which is typical as

first of the month flows come into the market. ISM data at 10:00 ET may be

market moving with good data bad for markets. NVDA and AI semis showing some

weakness being masked by rotation into other MAG7 with AMZN the lead pony and

TSLA poised to move on the back of China EV deliveries good and TSLA reporting

Tues. Financials are currently bid higher based on stress tests passing and

some announcing buybacks with earnings coming soon which is bucking the higher

yields. Commodities are receiving the Pavlovian reaction with US$ pulling back

which is contra the weak Chinese data. Interesting move in coal due to an

Aussie mine fire (WCC BTU). Bitcoin is bouncing, lifting the miners (IREN

CLSK MARA). Roaring Kitty is moving CHWY and may provide some energy into other

high short interest names if the market can catch fire today. Today’s

daily expected move levels: SPY (547.2-541.2), QQQ (482.5-475.8), IWM

(204.6-201.2), and SPX (5490-5430).

Stocks to watch TSLA, AMZN, FCX, IBIT, NVDA, MU, TLT

Spec Names CHWY, DJT, HUT

Pre-800ET

Indices IBIT, USO, FXI, ARKK, GLD, XLE, XLY, EFA, IWM, XLF, UNG, TLT, US$

S&P500 CEG, TSLA, WRK, SMCI, MU

Movers CHWY, HCC, SPR, BTDR, BEKE, IREN, HUT, LI, MARA, DB, SNOW, MP,

CLSK, TTE, DJT, BTU, GOGL, GME, FRO, NEP, MU, SMR

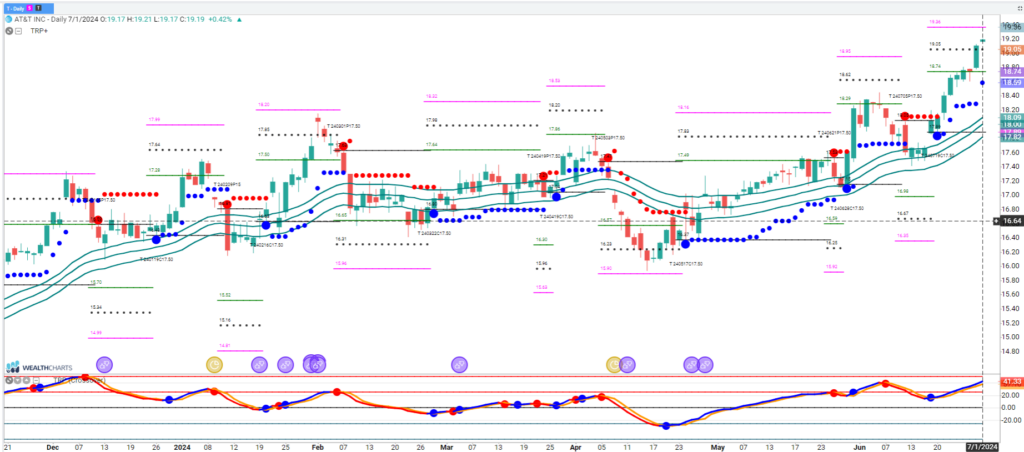

Trade Idea: T

Telecoms are breaking out in spite of higher yields. T is extended so this would be a risky momentum idea. GS has set a price target of 22 and DB has a target of 26. Dividend is 5.8% with ex-div Jul10. Large number of 20 strike calls which is a target.