Swing Trade Idea – July 2, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong, Asia – Slight negative global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals

· Yields: 30Y Bond+.46% Currencies: USA$ -.01% Vix: +1.0%

· News: USA:

Powell 930ET; JOLTS10ET EUR: Core CPI estimate 2.8% y/y vs 2.8%

Stocks: Roaring Kitty; SPR+3.9% Boeing buying SPR; IREN+3.8%. CLSK+2.8%

Bitcoin Miners Bid with bitcoin bounce; TSLA+3.7% Was lower

on weak China sales but just announced total production which beat

expectations. Growth+15% Q/Q -5%Y/Y. Looks like the squeeze will continue until

it doesn’t:) CRWD-2% downgrade PARA+3.5% Redstone agreeing to sell.

Overview: USA SPY 543.4 has support at 542.5 and 540 and resistance at

545 and 547.6 SPY expected move +/- 2.2. QQQ 479.7 with resistance at 480, 482

and 485 and support at 479 and 475 expected move +/- 2.9. Global equities

are divergent with Europe and USA large caps lower but USA small caps higher.

Long yields are lower which is usually a positive for small caps and tech. SPY

and QQQ are close to the lower edge of the expected move with negative momentum

overnight which sets up a potential for continuation lower or a bounce. MAG7 is

weak with AMZN +.4% but the remainder are red, led by TSLA which had

disappointing deliveries in China despite total EV sales in China higher. LLY

and NVO are lower after WH comments that prices are too high. Commodities led

by oil are bouncing with beaten down metals and aggs strong. China is up on

expectations for a liquidity injection which may be spurring commodities but we

have seen this story several times. Since the market cap weighted indices have

been lifted by MAG7 they remain the focus with NVDA 120 a key level to watch.

Powell 930ET and JOLTS10ET are market moving events which may reverse or

magnify the premarket set-up. Since macro set-up is positive, if MAG7

underperforms it may see outperformance in IWM and DJIA (which is price

weighted and will depend on UNH JPM MSFT). Today’s daily expected move levels:

SPY (547.6-543.1) QQQ (484.8-479), IWM (202.5-200)

SPX(5497.5-5452.7).

Stocks to watch TSLA, AMZN, FCX, IBIT, TSLA, CRWD, META, LLY Spec Names CHWY, DJT,

HUT,

Pre-800ET

Indices FXI, USO, TLT, XLE, UNG, IBIT, KRE, ARKK, XLK, QQQ, SPY

S&P500 PARA, PYPL, VTRS, LEN, CRWD,

LLY, TSLA, WRK, SMCI, CCL

Movers PARA, INFY, BP, PYPL, HON, HDB, VTRS, RCM, PSTG,

NVO, STM, STLA, LEN, VKTX, RBLX, CRWD, SE, LLY, TSLA

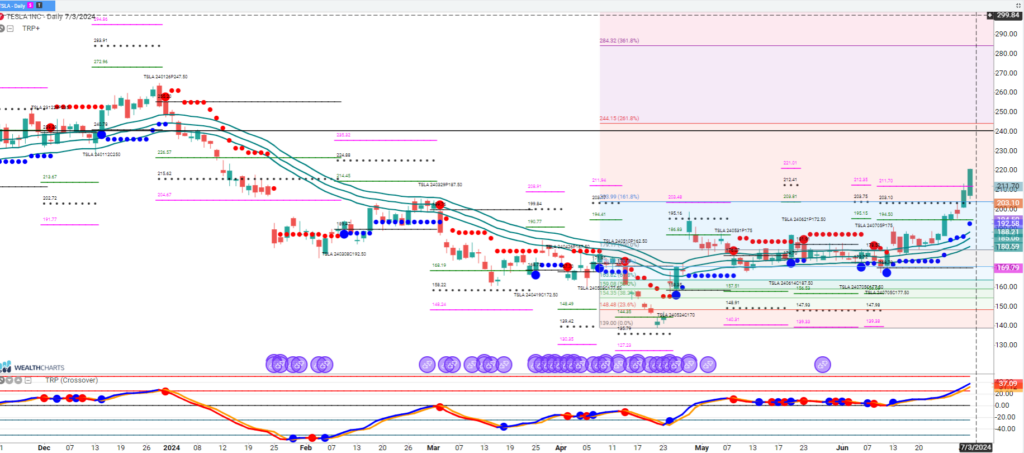

Trade Idea: TSLA

TSLA has been in a gamma squeeze and is up +5.4% after the announcement of quarterly deliveries. This is a short squeeze situation with actual deliveries lower but ahead of expectations. Unpredictable how high it can move as there are many out of the money calls but 220 is a good reference level with long above and short below. The parabolic move will at some point end but potential for it to reach 230 or 240 before bagholders start selling.