Swing Trade Idea – July 25, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Negative global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.7% Currencies: USA$ -.11% Vix: +1.9%

·

News: USA: GDP. U claims, Durable Goods 8:30 ET EUR:

Lagarde speaking 11:00 ET

Stocks: IBM +4%, NOW +6.7%, CMG +3.4%, CLS +3.3%, UL +6.6%, KLAC +2%, AZN -4%, STLA

-7.6%, F -13%, EW -22%, DOW -4.8%, SRM -11.7%, NEP -1.7%, HON -4.3%, MXL -27%,

NEM -3.4%, EPS

Overview: USA SPY 550.5 with support at 540 and 538, and resistance at

544, 545, and 550; SPY expected move +/- 3.2. QQQ 461.7 with resistance at 469

and 470, and support at 460, 457, and 455; QQQ expected move +/- 6. Macro: USA

GDP q/q 2.8% vs 2%, US Durable Goods -6.6% vs 0.3%; UE claims 235k vs 238k.

Initial reaction data was bond pullback as FED July rate cuts lower. Yen

continues to be strong which IMO is one of the reasons for weakness in MAG7 as

the carry trade unwinds and the crowded longs are sold and crowded shorts get

bought (e.g. IWM). AMZN is the top MAG7 stock potentially on deal with NBA,

AAPL news that Huawei strong growth vs iPhone, META getting a pre-market bid.

Earnings results are mixed with IBM, NOW, KLAC providing some support to tech

but F STLA weighing on autos; HON weighing on industrials. CMG was a standout

in the beaten down casual restaurant sector. S&P500 is at the bottom of the

weekly expected move after SPX broke 5500. SPX is negative gamma with 5425 the

largest negative level with 5400 the next large level below. Above 5470

potential to move to 5500. Negative gamma means market makers will be sellers

on declines and buyers on pops. In addition there is risk from CTA trend

sellers that will sell into declines and Vol control funds that will sell on an

increase in volatility. This makes the market risky with large swings in either

direction possible.

Expected moves: SPY (544.4-538), QQQ (469-457), IWM (221.4-214), and SPX

(5458.9-5395)

Stocks to watch AMZN, NOW, META, TLT, NVDA, ETHE, F, EW

Spec Names VKTX

Pre-800ET

Indices TLT, XLF, XLU, XLP, XBI, IWM, ETHE, XLV, GDX, IBIT, USO, GLD, FXI,

EFA

S&P500 HAS, NOW, IBM, RTX, CMG, CRM, AMAT, EW, WST, F,

AAL, LUV, DOW, HON, ON, MU, WDC, NEM, LULU, MCHP, ADI

Movers VKTX, HAS, NOW, UL, CLS, ASTS, BTI, SNY, RTX, IBM, RHHBY, JD, LI,

CRM, MXL, EW, WST, F, STM, NYCB, STLA, AAL, LUV, EDU, DOW, AZN, HON,

PAAS, MU, ON, JMIA

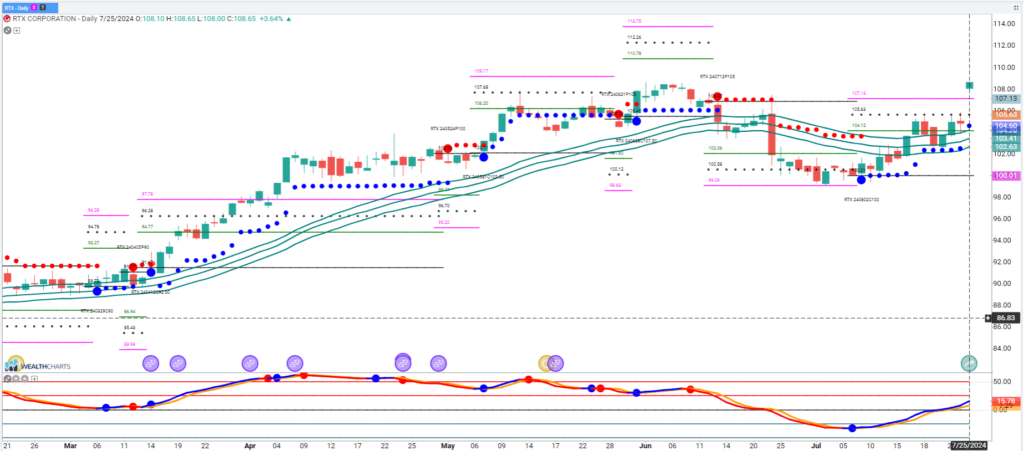

Trade Idea: RTX

RTX is following in the footsteps of LMT by moving up in earnings. Potential breakout candidate or can look for consolidation or pullback. Many names in the aerospace/defence group are outperforming as USA govt continues to support the sector. ITA is an ETF for the sector.