Swing Trade Idea – August 8, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.26% Currencies: USA$ -.11% YEN +.35% Vix: 24.8%

·

News: Japan: Dovish comments but Yen higher

premarket USA:UE claims 830ET

Stocks: LLY+11%, Z+11%, HOOD+2.5%, WWW+2%, EDIT+8%, FSLY-18%,

SEDG-16%, MNST-7.6%, BMBL-40%, EPS

Overview: SPY 519.2 support 516 515 511 and resistance 520 522 525

SPY expected move +/- 7.5. QQQ 435.4 with resistance 442.8 425 430

support 430 426.8 425 expected move +/- 8. UE claims reported were 233K vs

241k, which is insignificant but with the algos driving markets, this has

lifted indices with equity bought, US$ higher, TLT lower. Narrative that USA

entering recession is assuaged with a statistically inconsequential print;

however with puts and shorts to trade a breakdown, this can lead yet another

morning bounce. Question is how high and long it can last. Last 2 days the SPY

has retraced at the top of the daily expected move and major gamma levels.

Potential that one of these days the index will breakout so need to be careful

at resistance levels for reversals or breakouts. Note that this is all flow

related and premarket buying is primarily shorts covering rather than new longs

and the pops the last 2 days has been puts closing. Largest moves will be the

high short interest names and MAG7 which are the most liquid. NVDA AMD

are the leaders as semis have high short interest. IWM will lead due to short

interest and will be a good barometer for whether this is another pop to sell

or continuation if the bears are done selling. Expected moves SPY(526.2-511.1)

QQQ (442.8-426.8) IWM(207-197) SPX (5274.5-5124.5)

Stocks to watch IBIT, NVDA, LLY, QCOM, CRWD, MNST, SMCI, Spec Names ASPN, FLNC,

APLS, CLSK, MARA

Pre-800ET

Indices IBIT, ETHE, GDX, GLD, FXI, XLV, MSOS, EFA, UNG, USO,

XLF, IWM, XLC

S&P500 LLY, VTRS, CNP, VST, NEM, OXY, SMCI

·

NASI DDOG +5%, AMAT, NVDA

IWM ASPN+18%, APLS+11.6%, FLNC+11.3%, SAVA+4%, CELH-5%,

HIMS-2.3%

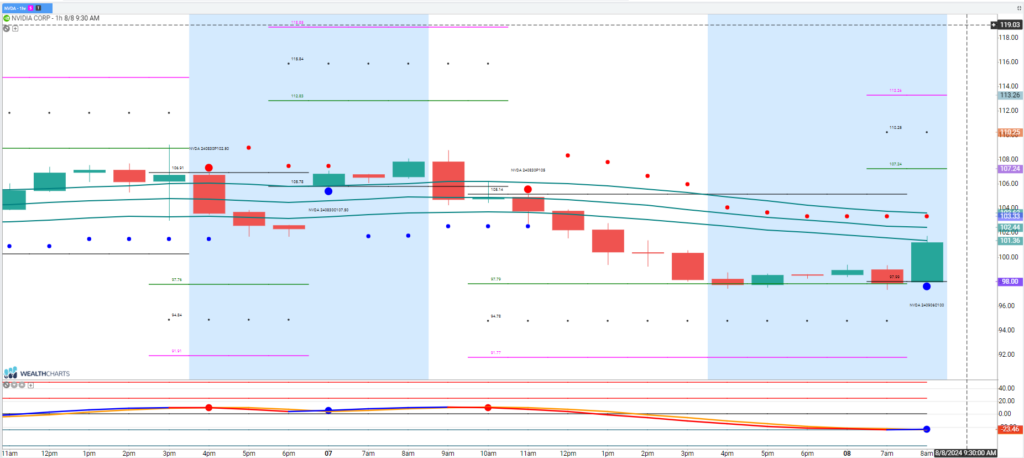

Trade Idea: NVDA

NVDA is trading higher as UE claims came in slightly lower than expected and shorts are covering. Strategy is trade long > 100 with target 105, 108 and look for reversals to fade NVDA back down. Below 98 can be a fade. One can trade the semi sector using the same logic. Premarket AMD and QCOM are bid with NVDA. Reminder that semis are in a down trend so look for pops to be fade opportunities.