Swing Trade Idea – September 12, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Market Setup- Pre-730ET

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Slight positive global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.27% Currencies: USA$ -.19% YEN +.45% BTC/USD -.29% Vix: 17.5

· News: USA: PPI UE claims 830ET; 30y bond auction 13ET Eur: ECB rate decision 815ET

· Stocks: SIG+14.6%,

KR0%, CAL-17% EPS ; MRNA -10.7% cutting forecast and R&D MU-2.7% downgrade ROKU+4.9% upgrade GILD+3% Positive

HIV data

Overview: SPY 556 support 555 550 and resistance 558.6 560 SPY expected

move +/- 4.2 QQQ 459.6 with resistance 470 473.5 475 support 465 463.7

expected move +/- 4.9. USA indices slightly positive ahead of ECB rate decision

and USA economic data. Wed SPY overshot the lower daily expected move and then

bounced to the upper level. Large squeeze with NVDA comments the catalyst. SPY,

QQQ are above the upper weekly expected move hence extended. High-volume

reversals can indicate a top or a bottom, need to be prepared for both. MAG7

led by GOOGL which has been a laggard with NVDA and AMZN continuing higher

after large moves Tues. Oil is bouncing with hurricane risk offsetting demand

concerns. *** 831ET USA PPI 0.2% m/m vs 0.1% Core PPI 0.3% m/m UE claims 230k;

ECB cut 25bps. Reaction: indices, TLT slightly lower, gold higher. *** In

theory higher PPI following higher core CPU are negative; however flows/short

covering are more important than macro. To keep it simple, SPY bullish above

555 and watch the MAG7 to see if one is a target of the hedge funds. Today

might be GOOGL.

Expected moves SPY(558.6-550.3) QQQ(473.5-463.7) IWM(211.2-206.6)

SPX(5595.7-5512.5)

Stocks to watch GOOGL, NVDA, AMZN, ROKU, GILD, MRNA, MU Spec Names

SIG

Pre-800ET

Indices USO, MSOS, IBIT, XLE, KRE, IWM, SLV, UNG, ARKK, TLT

S&P500 FCX, GOOGL, MRNA, MU, IPG

NASI GOOGL, MRNA, MU, AZN

All SIG, ALK, ROKU, SMMT, DHT, FCX, VIK, COIN, FRO, MARA, HOOD,

SE, VKTX, MRNA, MU, IPG, RYAAY, DJT, ASTS, AU, SHOP

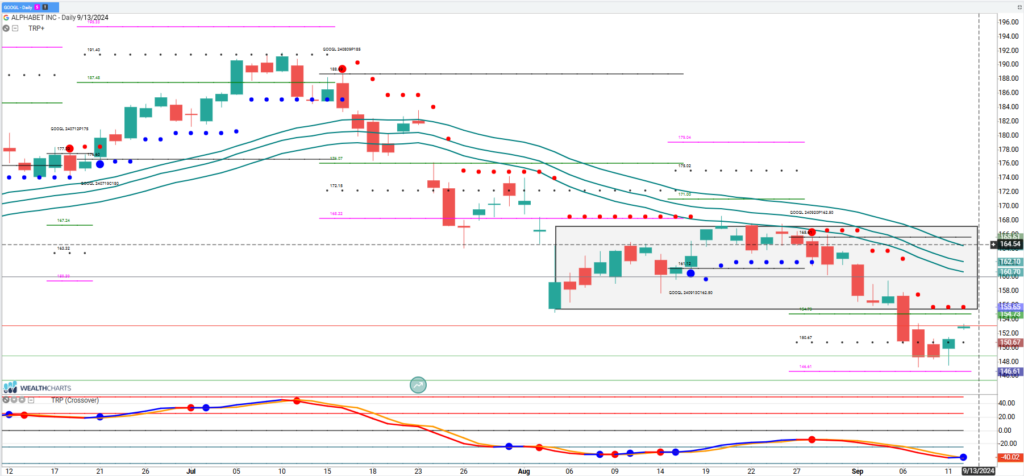

Trade Idea: GOOGL

GOOGL has been under pressure with anti-trust case weighing on the stock. GOOGL has large call positions at 152.5 which can be used as a reference level with calls building at higher level. Large volume gap up to 156. Premarket high 153.3 can be used for a momentum breakout or a pullback > 152.5.