Swing Trade Idea – September 20, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.07% Currencies: USA$ +.12% YEN -.87% BTC/USD -.45% Vix: 18.1

· News: JP: No rate change, Yen down 1% CAD: Retail sales 830ET

·

Stocks: FDX-13%, LEN-3.5% EPS NKE+7.9% new CEO CEG+8.6% 20y MSFT

deal Downgrades: ASML FDX PEP VLO Upgrade DRI Metals:

CCJ+5.8% AU +2.4%

Overview: SPY 569 support 565 560 and resistance 570 573 575 SPY

expected move +/- 4.2 QQQ 483 with resistance 485 487.4 490 support 480 479

475 expected move +/- 4. USA and European indices are lower since Thurs

short squeeze but Asia is higher. USA led by DJIA with small caps lagging.

Macro neutral with long yields slightly higher and US$ flat. Yen has moved .8%

lower which is usually bullish for Nasi and precious metals which are strong

premarket. MAG7 are muted ex-GOOGL which is +1%. Semis are down slightly with

NVDA -.4%. FDX major earnings miss is weighing on UPS are for at least a micro

second can raise doubts regarding the strength of the economy. LEN is down

after beating expectations, watch other builders. Today is a massive options

expiration with $5.1T in notional expiring. Typically Sept Opex day is negative

for S&P500 and the week following is down 1%; however this has been an

atypical year. Indices remain extended and the move Thurs was primarily short

covering so some caution is an idea today with Opex potentially leading to

gyrations as large positions are closed or rolled.

Expected moves SPY(573.4-565) QQQ(487.4-479) IWM(226-222) SPX (5755.6-5671.6)

Stocks to watch ETHE, SLV, CEG, VST, GOOGL, CCJ, NVDA, FDX,

LEN Spec Names

Pre-800ET

Indices ETHE, SLV, GDX, GLD, KWEB, XLU, UNG, FXI, IBIT, SMH, IYT,

USO, SPY, XLK, EFA

S&P500 CEG, NKE, VST, NEM, CRWD, GOOGL, PEG, FDX, LEN, ON, GM

NASI CEG, CRWD,

GOOGL, ASML, ON

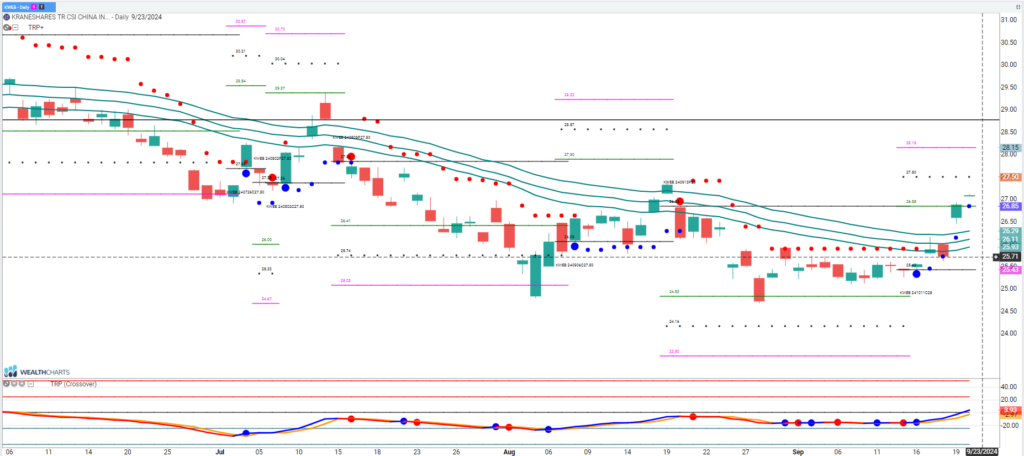

Trade Idea: KWEB

With some trepidation I offer KWEB as an idea. Asian stocks are outperforming SPY however China has been a laggard. Lower US$ is a catalyst for foreign stocks in general and will allow the PBOC to stimulate the economy. Longer term idea, more conservative to wait for a higher low and higher high; otherwise look for KWEB to take out 27.3 which was the recent high. Individual names: BABA PDD with the latter under a cloud due to USA govt action which is a generic risk with China.