Swing Trade Idea – October 1, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond +.7% Currencies: USA$ +.28%, YEN -.06%, BTC/USD +0.38%, Vix: 18.80

· News: USA: ISM mfg; Jolts 10ET; Bostic 11ET; East coast dockworkers on strike Eur: CPI 1.8% y/y inline; MFG PMI weak but improving Japan: Tankan mfg index inline

·

Stocks: PAYX, AY,I MKC+1.5%, EPS, LI, ZK, XPEV, EV sales data TEAM, F, ROKU, DDOG, upgrade CVS+2% breakup

discussion

Overview: SPY 573.5 support 570 568.8 and resistance 575, SPY

expected move +/- 3.4; QQQ 488 with resistance 490 492 support 486 485

484.3, expected move +/- 3.8. USA and Europe indices are flattish

after Mon dip and squeeze. Mon dip coincided with JPM roll, Powell hawkish

comments and Israel/Lebanon news but 0DTE puts closed which led to the

recovery. Now that SPX 5750 calls have been rolled higher out to Dec, the

indices are now free to make larger moves. The macro setup is tilted risk-off

with long yields, US$ higher and gold higher but may be quarterly rebalancing.

Today there is ISM data and Jolts data at 10ET which will be market moving.

Powell has made it clear that the Fed is focused on jobs hence any employment

data will move the algos. China names, especially the EV companies which

reported deliveries. TSLA Q3 data will be released Oct2 with the IV very

elevated ahead of the release and the Oct10 Robotaxi event. MAG7 led by GOOGL which broke

out Mon and META. AAPL lagging post breakout Mon on more reports of lagging

iPhone16 sales.

Expected moves SPY(577.2-570.4), QQQ (491.9-484.3), IWM(223-218.8), SPX

(5796.5-5728.5)

Stocks to watch GOOGL, META, CVS, AAPL, USO, Speculative DJT, ZK, LI

Pre-800ET

Indices ETHE, KWEB, UUP, FXI, GDX, TLT, GLD, MSOS, SLV, IBIT, USO, XLE,

UNG, XLF, XLK

S&P500 CVS, F, GOOGL, SWKS, AAPL

NASI DDOG, GOOGL,

AAPL

Other DJT, ZK, LI, PINS, HMY, FUTU, XPEV, MNSO, AA, CVS, F, AU, DDOG, ZIM, TRMD,

RITM, FRO, SWKS, CRK, AR, AAPL, STLA

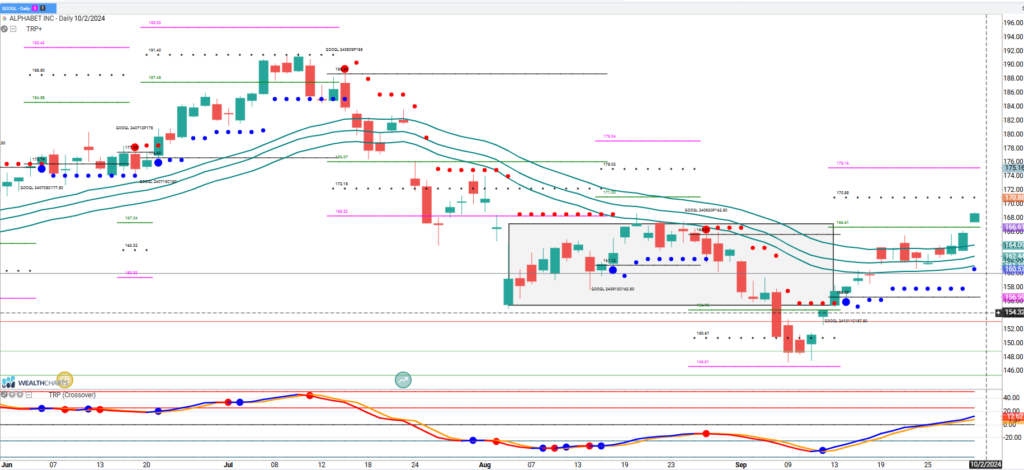

Trade Idea: GOOGL

GOOGL made a large move Mon and continuing today in premarket. GOOGL has been under pressure due to USA FTC action which has weighed on stock. Potential gamma squeeze with upside targets 170, 175. Stock is at a prior high which may act as resistance. GOOGL is very extended so pullback likely with 167 the midpoint from the premarket move. Strong support on a pullback at 165. If the cloud of govt action can lift, potential for GOOGL to be a catch up name in Q4 but earnings are coming in the next few weeks.