Swing Trade Idea – December 5, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong

Kong Asia – Neutral global set-up

- Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

- Yields: 30Y Bond -.37% Currencies: USA$ -.15% CAD +.03% YEN-.02% BTC/USD +4.0% Vix: 14.8

- News: USA: UE claims 830ET CAD: PMI 10ET

- Stocks: FIVE+13%, CHPT+11.5%, CM+1.8%,

DG+1.3%, S-15%, CAL-15%, AEO-13.7%, SNPS-8%, BMO-1.3% EPS

· Overview: SPY 607.4

support 605 and resistance 610 SPY expected move +/- 2.5 QQQ 523.2 with

support 520 515 resistance 525 526.1 expected move +/- 3.1. USA indices

are flattish premarket with macro factors mixed with yields slightly higher and

US$ lower. Bitcoin is the story of the day moving above 100k after Trump

nominated a crypto promoter to SEC chair and Powell compared bitcoin to gold.

Last few days there has been a rotation into tech from other sectors and

premarket this is muted but still seeing strength in ARKK/ARKF but less into

MAG7. MAG7 ex-TSLA have surged above the top of the weekly expected move hence

stretched. TSLA is the last MAG7 that is set-up to surge with 360 the call

wall. Large financials like BRK, JPM are below the weekly expected move and

worth watching for continuation lower or reversal if market rotates again.

Travel names, both air and cruise are being bought with 2 hands on a positive

forecast from LUV. Canadian banks are a mixed bag with laggard TD being hit the

most. Bitcoin names are en fuego with MSTR, miners and related names like COIN,

HOOD continuing there moves but quite stretched. SPX in positive gamma supports

the market with caveat that it is very extended and IV is dropping, which

increases the risk of a news item causing a larger move in either direction.

SPX6100 is the upside target and SPX6050 is a level to watch on the downside.

Expected moves SPY (610.2-605.2) QQQ (526.4-520.1) IWM (242.9-238.9) SPX

(6111.5-6061.5)

Stocks to watch TSLA, IBIT, LUV, HPE, COIN, AEO, S, TD Speculative

BTDR,

HOOD

Pre-800ET

Indices IBIT, UNG, ETHE, ARKK, EFA, KRE, FXI, TLT, UUP,

SMH, GLD,

S&P500 HPE, LUV, DAL, SMCI, UAL, DG, CCL, FI, AMAT, F, CRM

ALL FIVE, BTDR,

MSTR, HUT, AAL, HOOD, SOUN, IREN, COIN, MBLY, STLA, HPE, LUV, DAL, JD, LUNR,

PATH, AEO, NCNO, S, SIG, AS, FI, TD, FRO, SOFI, SMR

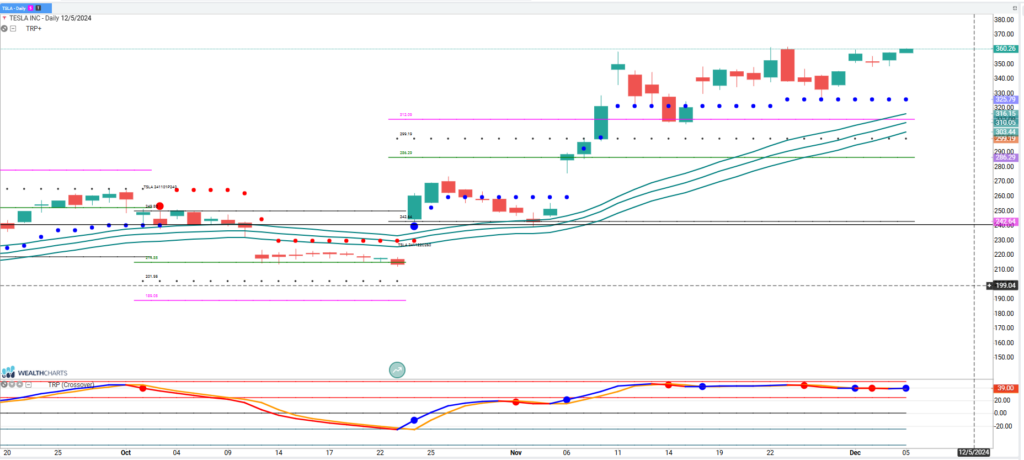

Trade Idea: TSLA

TSLA is the only MAG7 stock is not above the weekly expected move. The 360 strike has a large call position and above there is the potential for a squeeze to 370 or higher. It is also a level that has acted as resistance since mid-Nov so potential for pullback from that level.