Swing Trade Idea – February 11, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China,

Hong Kong Asia – Positive global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -0.5% Currencies: USA$ -.07%, CAD -0.12%, YEN-.24%, BTC/USD +0.3% Vix: 16.8

· News: USA:

Powell testifying 10ET; Many Fed speakers today

Stocks: SHOP-3.6%, MAR-2%, FIS-9%, KO+3.4%, SPGI+4%, ECL+4.3% EPS PSX+6%,

DD+5%, LDOS+3% Elliot mgmt involved

· Overview: SPY 602.8

Expected move 3.5 Resistance 605 608 Support 600; QQQ 526.5 Expected move 4.2

Resistance 528 529 530 Support 525 522. USA indices are lower after Monday no

tariff surprise short squeeze. Long yields are sharply higher which is

negative for equity, precious metals and large cap tech in general. MAG7 are

all lower led by NVDA and TSLA which is weighing on QQQ. China and industrial

metals which had big moves Mon are pulling back today. Energy, which made a big

move Mon is continuing up today. Stocks which have moved more than expected

move and hence can continue FLNC, AMKR, SLV, MT, LSCC, DD,

KO. Powell will be testifying today at 10ET and could lead to tape

bombs so take care. SPX iron condor seller is back with range defined at

6095-6030. These levels can be used for bounce or acceleration beyond.

Volatility is low which makes the market more susceptible to larger moves if

there is a catalyst like Powell or a WH tape bomb. If tech is sold today, fish

may be biting in the Dow type stocks (large cap divi). AAPL has turned positive

and WMT UNH XOM BRK are all green so always a bull market somewhere as long as

the rotation game is being played

Expected Move SPX (6101-6031) SPY (608-601) QQQ (533-525) IWM (229-225)

Stocks to watch PSX, KO, DD, AAPL, TSLA, NVDA Speculative LSCC, FLNC, SMCI

Pre-800ET

Indices USO, UNG, XLE, IBIT, KWEB, SLV, FXI, GDX, SMH, GLD, IWM,

QQQ, ARKG, TLT, ARKK, XLK

S&P500 PSX, DD,

ECL, SPGI, KO, LDOS, HUM, MTCH, FSLR, NUE, FIS, SMCI, AES, MAR, FCX, MU, VST,

ANET, AMD, MU, UBER

Other LSCC, TVTX, GDS, HE, CLF, IONQ, ZIM, EQNR, CMC, GMAB, CENX, FLNC, HUT,

VSAT, AMKR, ACLS, XPEV, GFS, ALAB, JD, HMY, TCOM, PDD, RIO

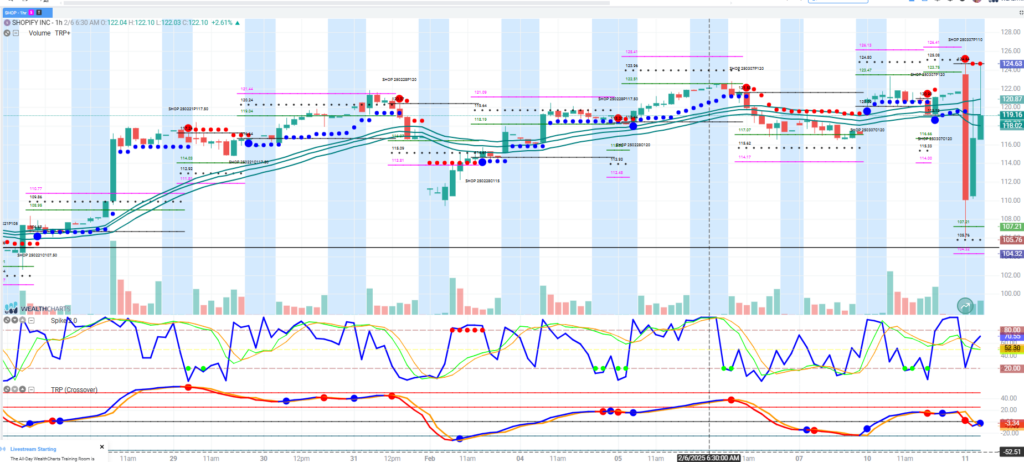

Trade Idea: SHOP

SHOP pulled back on earnings which appeared to be solid. Bouncing in the premarket back to the 120 call wall. This one can go either way today and is a day trade name with long over 120 and potential fade below 115. Very volatile with a range of 125-106 since 7am. Handle only with asbestos gloves.