Swing Trade Idea – July 18, 2024

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe, Japan, China, Hong Kong Asia – Neutral global set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -.5% Currencies: USA$ +.1% Vix: -1.4%

·

News: USA: Philly Fed, UE claims 8:30 ET; CB leading index

10:00 ET EUR: ECB rate decision 8:45 ET expect no change

Stocks: TSM+1.3%, VIRT+4.6%, INFY+3.8%, DPZ-11.5%, DHI-.6%, LESL-19%,

NOK-4%, NVS-2%, KEY-2%, WNS-5% EPS

·

Overview: USA SPY 558.3 with support at 557, 555, and 553.4, and

resistance at 560 and 562; SPY expected move +/- 3.5. QQQ 484.7 with resistance

at 485, 487, and 490, and support at 481, 480, and 476.5; QQQ expected move +/-

5.3. USA indices are mixed premarket and ahead of UE claims and ECB rate

statement. QQQ is bouncing following drop Wed that left price below the weekly

expected move and oversold. TSM beat and raised and had positive comments

regarding smartphone (AAPL) and AI which has provided a lift to AAPL NVDA SMCI

and semis in general with a 10% 2024 growth expectation. Macro is

slightly bearish for the recent leaders with long yields and US$ higher.

The recent dispersion trade i.e. long small caps short QQQ may reverse today

given how extended IWM is. MAG7 are all bid but NVDA is the leader and

can continue to run and if it does, it can suck capital from other stocks. NVDA

120 is the line in the sand. DPZ earnings forecast may weigh on other

restaurant stocks like PZZA MCD WING QSR etc that have been shorted due to

customers squeezed and hence squeezed higher over the last few days. Potential

for DPZ to continue lower. *Late* US UE claims higher than expected and ECB did

not increase rates as expected. Philly Fed 13.9 vs 2.9 is positive for economy.

Expected moves SPY(560.4-553.4), QQQ(487-476.5), IWM(225.3-219.3), and

SPX(5623-5553).

Stocks to watch NVDA, AMD, TSM, INTC, TSLA, META, DPZ, CRWD, IWM

Spec Names TOST

Pre-800ET

Indices SMH, XLK, UNG, QQQ, MSOS, XLC, SLV, GLD, FXI, ETHE, TLT,

KRE, IWM, USO, XLF

S&P500 FTNT, NVDA, AMD, SMCI, UAL, INTC, TSLA, FSLR, CMG, KMI,

CRWD, FCX

Movers INFY, TOST, SMR, STLA, FTNT, GCT, NVDA, SQ, STM, PINS, MRVL, AMD,

SMCI, TSM, FL, DPZ, NVS, CMG, LMI, LMND, CRWD, FCX, FIVE, ALK

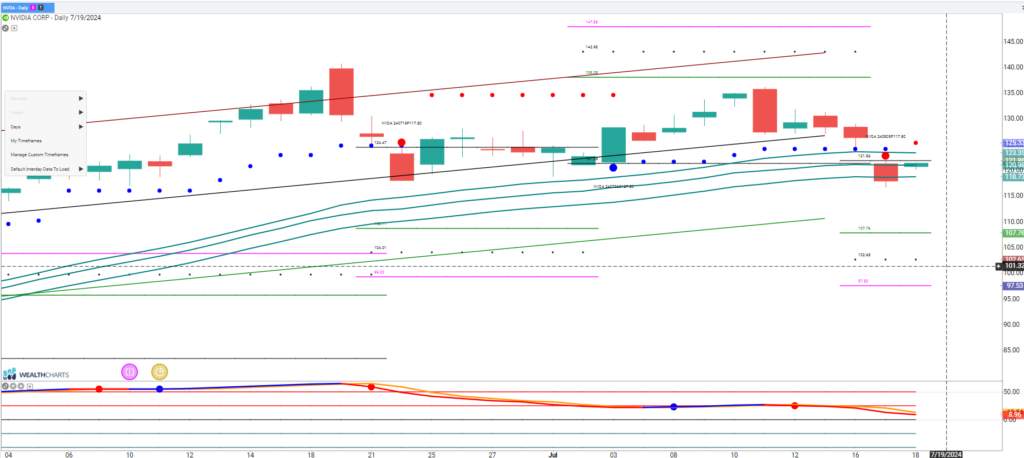

Trade Idea: NVDA

NVDA is moving higher after a 14% drop since last week. TSM earnings comments regarding AI are providing a boost premarket. Large call positions at 120 set a bull/bear level. Expected move into Fri close is +/-5. Above 122.6 there is a gap to 126 with high volume resistance at 128. Below 120 can revisit 116.7 or lower. NVDA will lift the other semis stocks with AMD QCOM and MU the option trader faves. TSM > 179 potential for 184 but TSM earnings did not knock my socks off. TSM capital guidance not strong positive for ASML AMAT etc but they will be lifted if SMH lifts.