Swing Trade Idea – January 27, 2025

Laurie’s Abbreviation Index:

** ‘div’ – dividend

** ‘m/m’ – month over month

** ‘y/y’ – year over year

** ‘Inven’ – inventories

** ‘mfg’ – manufacturing

** +/- – plus or minus, positive or negative

** Underlined text – higher volume premarket

** ‘d’ – day

** ‘Y’ – year

**govt – government

Color Key: Positive – Neutral – Negative

Global Markets: USA, Europe,

Japan, China, Hong Kong Asia – negative global

set-up

· Commodities: Gold, Silver, Oil, natgas, AGGS, Industrial Metals, Bitcoin

· Yields: 30Y Bond -.03% Currencies: USA$ -.29% CAD +.20% YEN-.37% BTC/USD -4.3% Vix: 18.3

· News: USA: DeepSeek, a China AI company released results that showed comparable results as Chatgpt at a substantially lower cost and without state of the art NVDA chips China: mfg and services PMI below expectation indicating issues remaining

· Stocks: T+.46%, SOFI-7.4% EPS NVDA-11.7%, ORCL -7.9%, APH -10.6%

· Overview: USA

indices are well below the daily expected move with QQQ testing the bottom of

the weekly expected move. SPY low 590 (SPX 5920) but premarket the SPX put

sellers are selling 5960 which can act as a bull/bear level with risk down to

SPX 5900. Below 5900 there is risk to 5800. The SPY has risen rapidly since

Jan14 with many overnight gaps and this pullback closes 3 of the gaps with the

remaining gap below 590. DeepSeek news is causing questioning of the approach

to AI that NVDA and hyperscalers have taken and hence the names that have

benefit from AI euphoria from semis like NVDA, MU, AVGO to power generation

like VST CEG are getting hit. The DeepSeek algo is opensource which can

discount the value of the hyperscaler proprietary algos hence those names are

being hit. IMO if DeepSeek is real, it can reduce the cost of AI and in theory

should improve the margins for hyperscalers that make their money from

advertising. This week is a busy week with FOMC, PCE and major earnings

reports. Indices were technically extended and susceptible to a pullback if a

catalyst should appear. MAG7 are negative with AAPL the least affected and NVDA

the most. China stocks are higher despite poor economic data which may be

DeepSeek related. Assuming that SPX holds the lows, money will rotate to safety

sectors like utilities, staples and bonds. Leading SPX names premarket: T, VZ

(telecom), DUK, SO utes; PG, KHC, MO staples; JPM, BRK financials As long as

money is rotating into non-tech sectors rather than selling all stocks, indices

can hold. Remains to be seen how much lower the tech names can fall today so

take care.

Stocks to watch TLT, T, WMT, NVDA, ORCL, VST, PLTR Speculative CORZ

Pre-800ET

Indices TLT, FXI, KWEB, XLP, XLV, ETHE, SMH, XLK, IBIT, UNG, ARKK, QQQ,

IGV, SPY, XLY

S&P500 ABT, RTX,

BMY, WMT, PM, DUK, V, GEV, VST, CEG, NVDA, ANET, APH, ORCL, ETN, NRG, PLTR, TT, PWR, CDNS

Other BTI, BABA, DX, ABT, BECN, BBVA, AEP, BMY, DUK, CORZ, BE,

CAMT, CIEN, CEG, ANET, APH, ARM, ETN

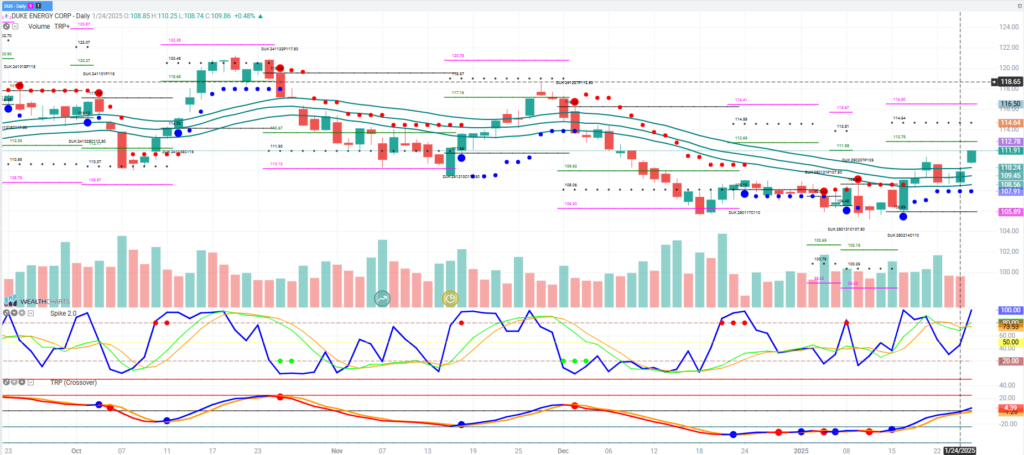

Trade Idea: DUK

DeepSeek is causing a pullback in the tech sector and causing the extended indices to pullback. Bond yields are falling and money is rotating at least today into more defensive areas. DUK is an example of an electric utility which is defensive. Regardless of what unfolds, there is a need for more electricity and improvements in the infrastructure. If yields continue to fall, utes in general can benefit.